How to File Income Tax Return Online, this is how you can fill income tax online

The last date for filing income tax has passed, and if you have not filed your return yet, then file it. However, now you will be fined. Know the method of Income Tax e-filing (Income Tax Online efiling). The process of filing Income Tax Return online is not very difficult. Today we will tell you the method of Income Tax e-filing. You can save your time by filing income tax online.

Follow these steps to file Income Tax Return:

- To file income tax return, first you have to go to the online tax filing site of Income Tax Department IncomeTaxIndiaeFiling.gov.in You have to go to. After this, you have to register yourself here.

- If you are filing your return for the first time, first click on the ‘New Registration’ tab and after providing all the relevant information, create your profile and password. While creating your user ID, make sure that you have an active email ID and mobile number and that you have provided the correct information.

- This is important because the communication by the department will be done here. The registration process will be completed by clicking on the one-time password on your mobile and the activation link sent through email. And if you are already registered, go to ‘Registered User’. For any kind of assistance, you can click on the ‘Customer Care Tab’ to get the helpline number or call the customer care center.

- After this, click on the login tab and fill in the required information, your user ID, PAN number, password, date of birth (as mentioned on the PAN number) and captcha code. Now click on the login button given below.

![]()

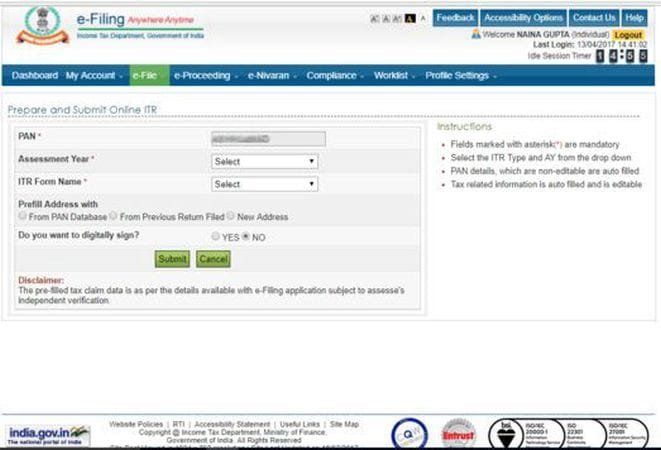

- After signing in, your account dashboard will open as seen in the picture. Then click on the e-file tab and select the option ‘Prepare and Submit ITR Online’.

![]()

- Now, select the relevant form and the year for which you want to file the return (Assessment Year). Taxpayers can enter their address here, the same as given for PAN, the same as given for the last return or a new address. The department asks you to digitally sign your return. If you select ‘Yes’, you will need to upload your signature which needs to be pre-registered on the income tax website.

- Now click on ‘Submit’ and the website will redirect you to another page to fill the form you have chosen. Before filling the ITR form, you should read all the ‘General Instructions’ given at the beginning of the form to know what to do and what not to do.

- After this, you will be asked to fill in different tabs like general information, income information, tax information and tax payment information in the ITR form. Make sure that the tax payable shown in the online form matches your calculation.

- Before making the final submission, we recommend that you save all the data entered and double-check it to avoid any mistakes. Once you click on the ‘Preview and Submit’ button, a preview of your ITR form will appear before the final submission.

- Once you click on the ‘Submit’ button, your ITR will be uploaded and you will then be asked to verify the return using any of the available options.

- If you have already registered your digital signature, you will be asked to upload the digital signature at the time of submitting the final ITR. Once uploaded and submitted, the ITR filing process is complete and no verification is required. You will also not need to send any receipt (Acknowledgement/ITR V) to CPC Bengaluru.

- However, if you have not uploaded a digital signature while filing the return, you can verify your return using your Aadhaar OTP or electronic verification method. Apart from this, you can sign the printout of ITR V and send it to CPC, Bengaluru within 120 days of e-filing.

- After your return is successfully uploaded, a receipt (Acknowledgement/ITR V) will be sent to your registered email ID. This receipt will also be visible in your account on the e-filing website from where you can download it if required.

- Once you verify, the department will start processing your ITR. Once your ITR is processed, you will be notified through the same email and an SMS on the registered mobile number.

Gadgets 360 for the latest tech news, smartphone reviews and exclusive offers on popular mobiles Android Download the app and let us know Google News Follow on.